irs unemployment tax refund status tracker

If you use e-file your refund should be issued between two and three weeks. Federal law requires employers to withhold taxes from an employees earnings to fund the Social Security and Medicare programs.

How To Find Your Irs Tax Refund Status H R Block Newsroom

Taxpayers can find out if and when their refund was mailed and when they should receive it.

. Web If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records online. This service is available 7 days a week hours may vary. Heres how to check your tax.

Your Social Security numbers Your filing status Your exact whole dollar refund amount You can start checking on the status of you return within 24 hours after the IRS received your e. Web Using the IRS tool Wheres My Refund go to the Get Refund Status page enter your SSN or ITIN filing status and exact refund amount then press Submit. However IRS live phone assistance is extremely limited at.

Unemployment Tax Refund Still Missing You Can Do A Status Check. Visit IRSgov and log in to your. These are called Federal Insurance Contributions Act FICA taxes.

You can also request a copy of your transcript by mail or through the IRS automated phone service by calling 1-800-908-9946. If you use e-file your refund should be issued between two and three weeks. Ad Learn How to Track Your Federal Tax Refund and Find the Status of Your Direct Deposit.

You wont be able to track the progress of your refund through the IRS Get My Payment tracker the Wheres My Refund tool the Amended Return Status tool or another IRS portal. All you need is internet access and this information. Web If you file your taxes by mail you can track your tax return and get a confirmation when the IRS has received it.

The system even allows taxpayers to begin the procedure to trace a lost refund check. Web The answer depends on how you filed your return. The IRS should issue your refund check within six to eight weeks of filing a paper return.

Your Social Security number or. You can call the IRS to check on the status of your refund. If youre anticipating an unemployment tax refund your best bet is to track the status of it and see when it would arrive in your bank account.

Web One of the lesser-known provisions of the 19 trillion American Rescue Plan was a substantial tax break for recipients of unemployment benefits which offers a considerable tax exemption. Web Irs unemployment tax refund How to track the status of your tax refund onlineWatch Our Other VideosThe IRS Is Massively Late Sending Millions of Tax Refunds. If you chose to receive your refund through direct deposit you should receive it within a week.

To do so use USPS Certified Mail or another mail service that has tracking or delivery confirmation services. Learn more about FICA. The systems are updated once every 24 hours.

This is the fastest and easiest way to track your refund. Web Irs unemployment tax refund status tracker. Web The Automated Refund Inquiry System provides more extensive information about the status of State tax refunds.

Web The IRS should issue your refund check within six to eight weeks of filing a paper return. Web To check the status of your 2021 income tax refund using the IRS tracker tools youll need to provide some personal information. Web Unemployment Refund Tracker Unemployment Insurance TaxUni.

Web How to Check Your Refund Status. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form 1040 Additional Income and Adjustments to Income PDF.

As an employer the City also pays a tax equal to the amount withheld from an employees earnings. You can check on the status of your refund by clicking on the links below. Heres how to check online.

Web If the IRS determines you are owed a refund on the unemployment tax break it will automatically send a check. Use the Wheres My Refund tool or the IRS2Go mobile app to check your refund online. If you chose to receive your refund through direct deposit you should receive it within a week.

Make sure its been at least 24 hours. The only way to see if the IRS processed your refund online is by viewing your tax transcript. If you entered your information correctly.

You can check on the status of your refund by. Check For The Latest Updates And Resources Throughout The Tax Season. Your Social Security number or Individual Taxpayer Identification Number your filing status and your refund amount in whole dollars which you can find on your tax return.

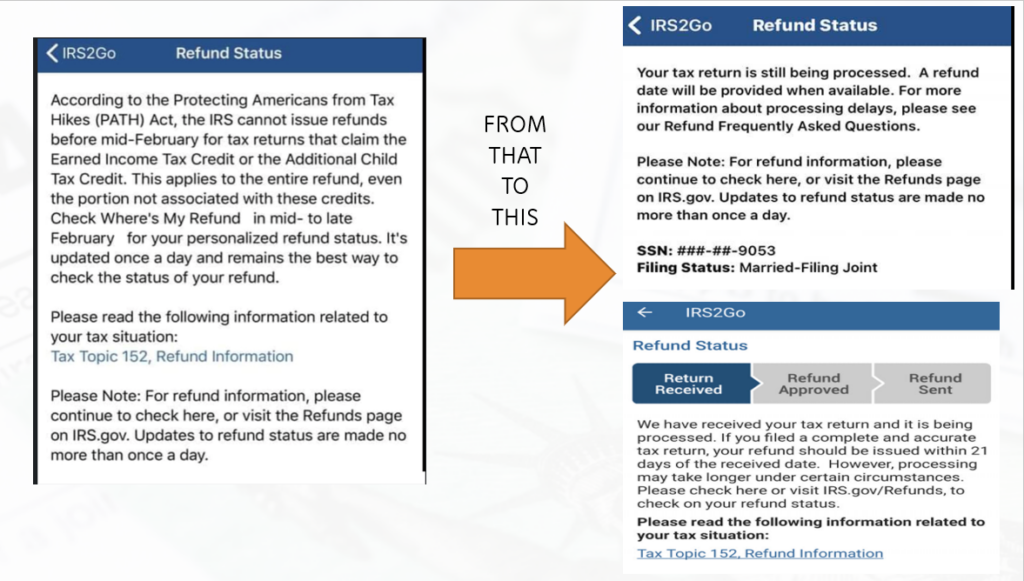

Check your unemployment refund status using the Wheres My Refund tool like tracking your regular tax refund. Web The IRS online tracker applications aka the Wheres My Refund tool and the Amended Return Status tool will not likely provide information on the status of your unemployment tax refund. Web March 5 2019 The best way to check the status your refund is through Wheres My Refund.

2022 Irs Tax Refund Breaking News Refunds Sent Delays Adjusted Refunds Amended Returns Youtube

Unemployment Tax Refund Update What Is Irs Treas 310 Weareiowa Com

Tax Refund Timeline Here S When To Expect Yours

Irs Faces Backlogs From Last Year As New Tax Season Begins Npr

Where S My Refund Where S My Refund Status Bars Disappeared We Have Gotten Many Comments And Messages Regarding The Irs Where S My Refund Tool Having Your Orange Status Bar Disappearing This Has

Tax Refund Status Is Still Being Processed

Refund Status Your Tax Return Is Still Being Processed And Refund Date To Be Provided Why And How Returns With Errors Are Being Handled By The Irs Aving To Invest

Yes Fourth Stimulus Check Update Irs Tax Refunds 10 200 Unemployment Tax Refund Irs Taxes Checks

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Tax Refund Timeline Here S When To Expect Yours

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

Tax Deadline 2021 Irs Tax Refund Status Where Is It And How Do You Track Your Money With Irs Tools Marca

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Unemployment Tax Refunds Irs To Send More Payments Before End Of Year Gobankingrates

Irs Tax Law Change Will Trigger Wave Of Refunds Wwlp

2 8 Million People Are Getting Irs Refunds This Week 10 Million More May Get Money Too Wbff

2022 Irs Tax Refund Update Refunds Approved Tax Return Backlog Irs Notices Amended Returns Youtube

Stimulus Check Status Update Irs Payment Timeline What To Know About Plus Up Money Irs Send Money Tax Refund